AS SEEN ON

let's create stress-free success in 2023

Start, Grow & Scale Your Service-Based Business To Consistent 10K Months Without Growing An Agency Or Creating A Course

The #1 GOAL of Serve Scale Soar® is to help you scale with simplicity.

The Serve Scale Soar® membership experience is the ONLY private membership for service providers who want to get to 10K+ months without hiring a team or creating a course all while putting their life first and business second.

With Action Plans to help you focus on making forward progress in your business, templates to save you time, strategies that been proven to work no matter which service you provider and ongoing LIVE support and Q&A with me.

You have everything you need in order to reach your goals and scale your business.

⭐️DOORS ARE NOW OPEN FOR A LIMITED TIME⭐️

Have you been told that the only way to scale to six figures is by growing an agency or creating a digital product?

I'm here to tell you there is a BETTER way.

As service providers, we hear all the time that the ONLY way to scale our business is by growing an agency or creating a digital course or product. But I am here to tell you that

you can do it with your services as a solopreneur.

Serve Scale Soar® is designed to help you get hyper-focused on the activities that scale your business and stop doing #allthethings so that you can make more, work less, and spend more time with your family.

Can You Imagine Six Months From Now...

Waking up in the morning with discovery calls on your calendar, invoices paid, and contracts signed.

Not being on call for your clients 24/7 and having systems in place to manage them, so you have more time with your family. And finally enjoy a vacation that doesn't include constant dinging of slack messages.

Not having a laundry list of services, but only providing one or two services and charging a premium price for those. While becoming an expert in your industry and niche.

Knowing exactly how to find clients without being on a never ending content creation hamster wheel or spending your days sending spammy DMs.

Landing your dream client on a discovery call that was only 15 minutes long.

Having consistent $10K months and saving up for that Disney vacation, paying off stinkin' student loans, building your dream home or maybe so you can bring your husband home from his 9-5.

If any of this sounds like a dream, I want you to know that it’s 100% possible for you. And I know that because I’ve been (and hundreds of my students have been) exactly where you are now.

And I've created a proven system to help you hit your $10K months, so that you get more time back with your family while creating a life full choices.

BEFORE I TELL YOU ALL ABOUT THIS BUSINESS CHANGING MEMBERSHIP, LET'S TALK ABOUT WHO THIS IS REALLY FOR...

SERVE SCALE SOAR® WAS LITERALLY MADE FOR YOU IF...

You're an online done-for-you service provider who is ready to start, grow, or scale your business to $10K months without hiring a massive team or creating a course. And you're ready to do it with a proven step-by-step roadmap instead of waisting a ton of time going down the endless rabbit hole of Google and YouTube.

You're sick of doing #allthethings for all your clients and you're ready to create a signature services that pays you a premium price, streamline your systems so you can stay out of the backend of your business, and attract your dream clients that don't make you want to pull out all your hair.

You know how important ongoing training and support is to the growth of your business and you want to be part of a group of like-minded entrepreneurs who come together, to encourage, and support one another no matter if it's business or life related.

Serve Scale Soar® isn't about consuming more content, it's about implementing and taking action on what you learn.

Serve Scale Soar® is about taking action and making progress inside your business. We meet you where you currently are in your business and give you the customized path of focus so you can fight through the shinny object urges and focus on the things that really move your business forward. And we give you all the resources, templates, and trainings you need to make it a whoooole lot easier while keeping your business simple.

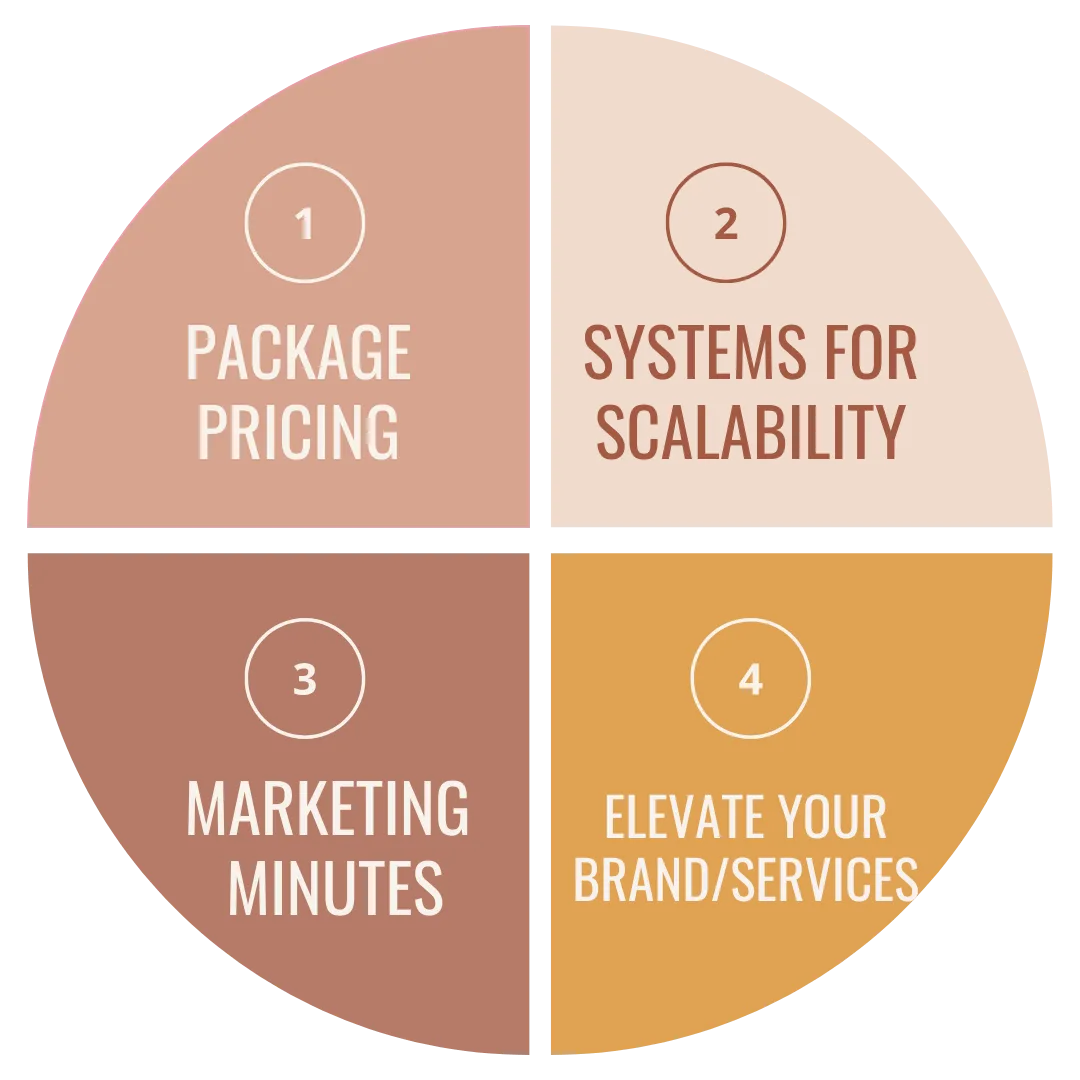

Whether that's pricing your services, setting up systems, finding your first or next client, or taking your business to the next level by offering premium services, Serve Scale Soar® is organized into

4 growth phases to keep you focused and moving forward.

Package pricing

We’ll start out with the very FIRST step — Package Pricing Formula™. Never wonder how to price your services again! After phase one you'll move from hourly to packages and confidently price your services. You'll also know exactly who you serve and how you serve them.

Your pricing sets the tone for everything in your business. And most service providers struggle when it comes to confidently pricing their services because they just don't know how or what to charge.

In Phase 1 you'll decide on the the 1-2 services you'll provide, who you want to serve, and how much you'll charge. Specifically, we’ll look at how to set your pricing to match your goals not only for your business, but more importantly, the life you want to live. I guide you through the same exercises and processes I used to scale my business from $0-$100K in 10 months and what I have taught hundreds of others, so you can feel confident pricing your services.

systems for scalability

Just like Beyonce, everyone only gets 24 hours in a day. But how you use those 24 hours is a totally different story. And chances are, if you started your business, it wasn't to be spending the majority of your time in the backend sending contracts, proposals, and invoices. (oh my!)

In Phase 2 - Systems For Scalability you'll learn how to set up simple systems that help you scale, while getting more time back! And we'll kick all those tech nightmares and overcomplicated workflows to the curb.

Most people believe systems are expensive and too complicated, but I'm going to give you ALL the templates, tutorials, and processes you need to get your systems up FAST! And while spending less than $35 per month on software!

marketing minutes

Successful service providers know that in order to scale their business they have to focus on ACTIVE marketing minutes. And no that doesn't mean posting a dancing reel on the gram and crossing your fingers hoping it lands your next client.

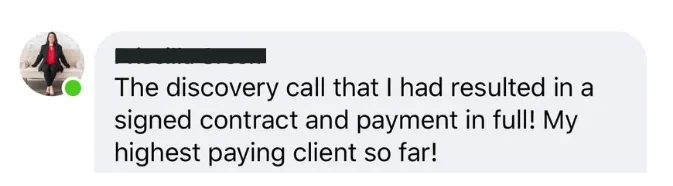

Discovery calls are the number 1 needle-moving activity you can do in your business and if your business isn’t focused on actively finding clients and discovery calls you'll find yourself under-booked and overwhelmed.

So in phase 3 - Marketing Minutes we cover how to find clients, hold and land clients on a 15 minute discovery call, and how to create an onboarding process that wows them and has them referring you to all their friends.

elevate your services & brand

“I've hit a cap and have no idea how to break this plateau.”

Has the voice in your head ever said that?

It’s so common for this to happen once you've maxed out on retainer clients.

However, when done right, you can continue to grow your revenue without adding more retainer clients or time to your workload. And it doesn't involve hiring a team or creating a course.

In phase 4, you'll learn exactly how to break through your plateau, elevate your services, charge more, and become the go to expert in your niche and services.

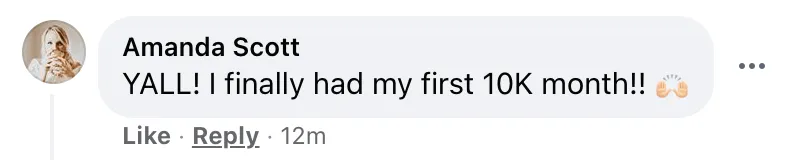

Amands S Showit web designer

“I hit my first 10K month...Brandi seriously THANK YOU. I couldn't have done It without you and your trainings! ”

WILL THIS BE YOU NEXT?

AND NO I'M NOT ABOUT THE LOCK OUT LIFE

I'M ABOUT INSTANT GRATIFICATION

When you join us inside Serve Scale Soar® today, we aren't holding anything back or locking you out of previous content. You'll gain instant access to ALL past and current trainings, templates, and tutorials with a click of a button.

I created Serve Scale Soar® to eliminate overwhelm — not create more...

to make business easier for you, not harder.

That's why you'll have a curated area of content that you can jump into right away that's specifically focused on where you are in your business RIGHT NOW. We call it just in time learning.

More importantly, all the content has action items so you know EXACTLY what your next steps for growth are and you can start taking action faster.

If you're ready to start, grow, and scale your service-based business;

NOW IS THE TIME TO GET STARTED!

Yes! let's do the dang thing...

Join us Inside

Serve Scale Soar®

Choose Your Subscription Plan

PAY MONTHLY

$97/MONTH

This option is for service providers, who know success is a just around the corner (even if they are just getting started)...

And are excited to take advantage of a lower entry point and enroll in a community that will offer the support they need to start and grow their service-based business faster and put profit in their pocket so they can show up for themself and their family in a big freakin' way.

YOU'LL RECEIVE THESE EACH MONTH

Action Plan Of The Month

Deep Dive Training With Brandi

Template Of The Month

Live Q&A for the questions you need answered with Brandi

PLUS YOU'LL UNLOCK THESE BONUSES

Scale With Simplicity™ Course

All Previous Trainings and Templates

Keys To Our Bonus Vault -- Packed With Mini Courses To Help You Find Clients & Get Your Systems Set Up Fast!

no buyers remorse here! you can cancel your membership at any time even though you probably wont want to.

MOST POPULAR

$970/YEAR

This option is for someone who is serious about long-term growth in their business and loves to take advantage of a GREAT deal. By enrolling in an annual membership, you'll not only get the best price, but you'll also unlock these special perks.

YOU'LL RECEIVE THESE EACH MONTH

Action Plan Of The Month

Deep Dive Training With Brandi

Template Of The Month

Live Q&A for the questions you need answered with Brandi

PLUS YOU'LL UNLOCK THESE BONUSES

Scale With Simplicity™ Course

All Previous Trainings and Templates

Keys To Our Bonus Vault -- Packed With Mini Courses To Help You Find Clients & Get Your Systems Set Up Fast!

PLUS YOU'LL UNLOCK THESE ADDITIONAL BONUSES FOR

ANNUAL MEMBERS ONLY

Get TWO months free (save $194)

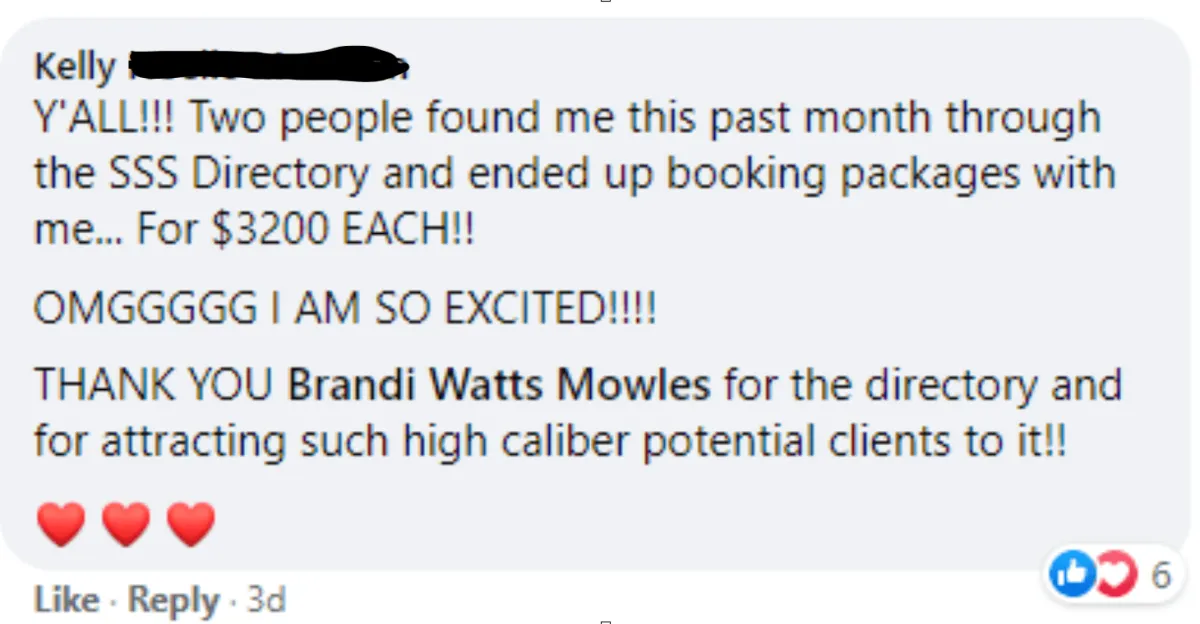

Get added to our Preferred Service Provider Directory

Access To My Private Scale With Simplicity™ Podcast

Access To Our Private Monthly Serve Scale Soar® Members Only Podcast

30 day money back guarantee.

🔓 WHEN YOU ENROLL IN THE ANNUAL MEMBERSHIP YOU'LL unlock THESE BONUSES 🔓

ANNUAL MEMBER ONLY BONUSES

Let us help connect you with clients

SERVICE PROVIDER DIRECTORY

01

Every single day we get an email or DM that says, "Hey Brandi or team, I am looking for [Insert type of service provider]

and I was wondering if you had any recommendations."

And our old way of doing things wasn't serving them or you, so instead we created a Preferred Service Provider Directory with only members of Serve Scale Soar® who are committed to their business and business growth through our membership.

So jump to the front of the line when you join us inside with the annual or lifetime membership option.

TAKE SERVE SCALE SOAR® ON THE GO WITH YOU

2 Private Podcasts To Help You Get Unstuck

02

When you join Serve Scale Soar® EVERYONE get access to our Q&A recording, Action Plans of the Month and Deep Dive Trainings, but only those who join with the annual subscription get access to not ONE but TWO private podcast.

Our Scale With Simplicity™ Podcast takes you through the 4 phases of our Serve Scale Soar® framework and this private podcast allows you to take it on the go. No matter if you're on your way from dropping kids off, taking your morning walk or sitting at a soccer game. Serve Scale Soar® is available at your fingertips.

Second Podcast you'll get access to is our Serve Scale Soar® Monthly Members Only Private Podcast. Where you can listen to our Monthly Deep Dives, Action Plans and Q&As.

With these exclusive bonuses you can pop in your Airpods and get unstuck with the press of a button.

Our members favorite is listening to the discovery call lesson before each of their calls.

THE USP OF THIS BONUS

Name of the Super Bonus

03

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id. What are they suffering from? Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam

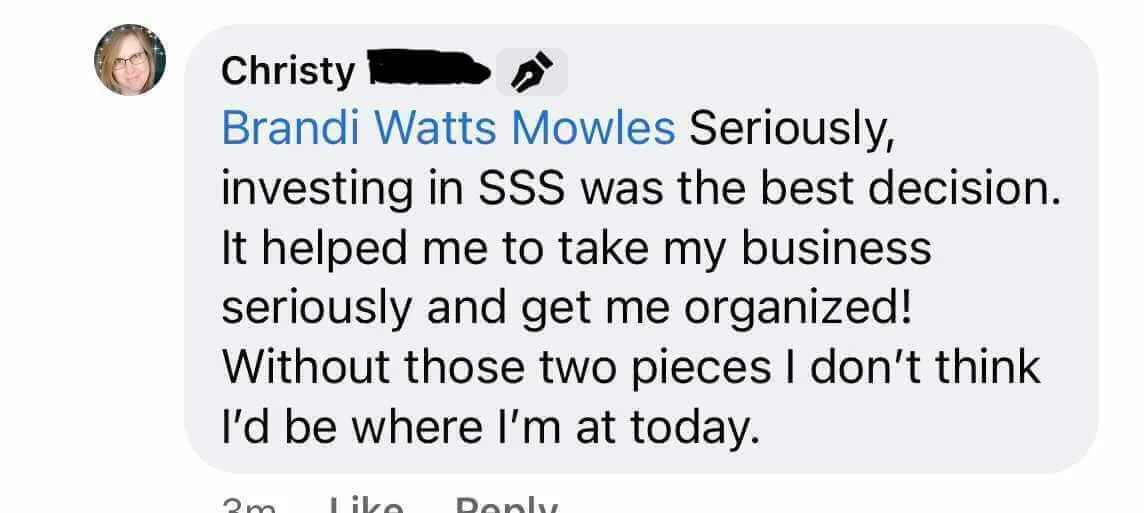

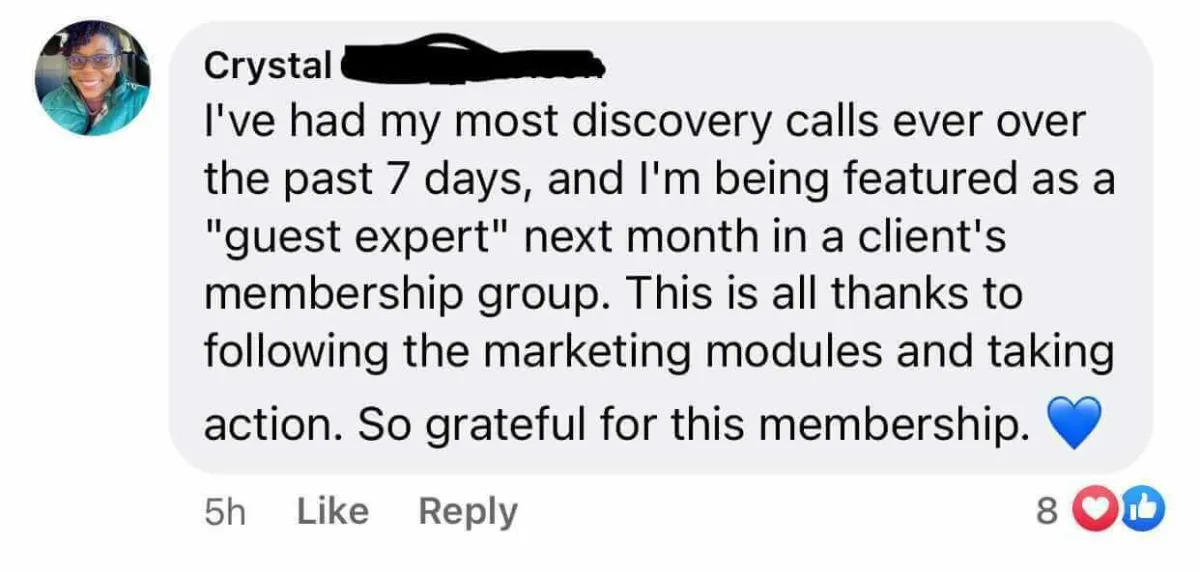

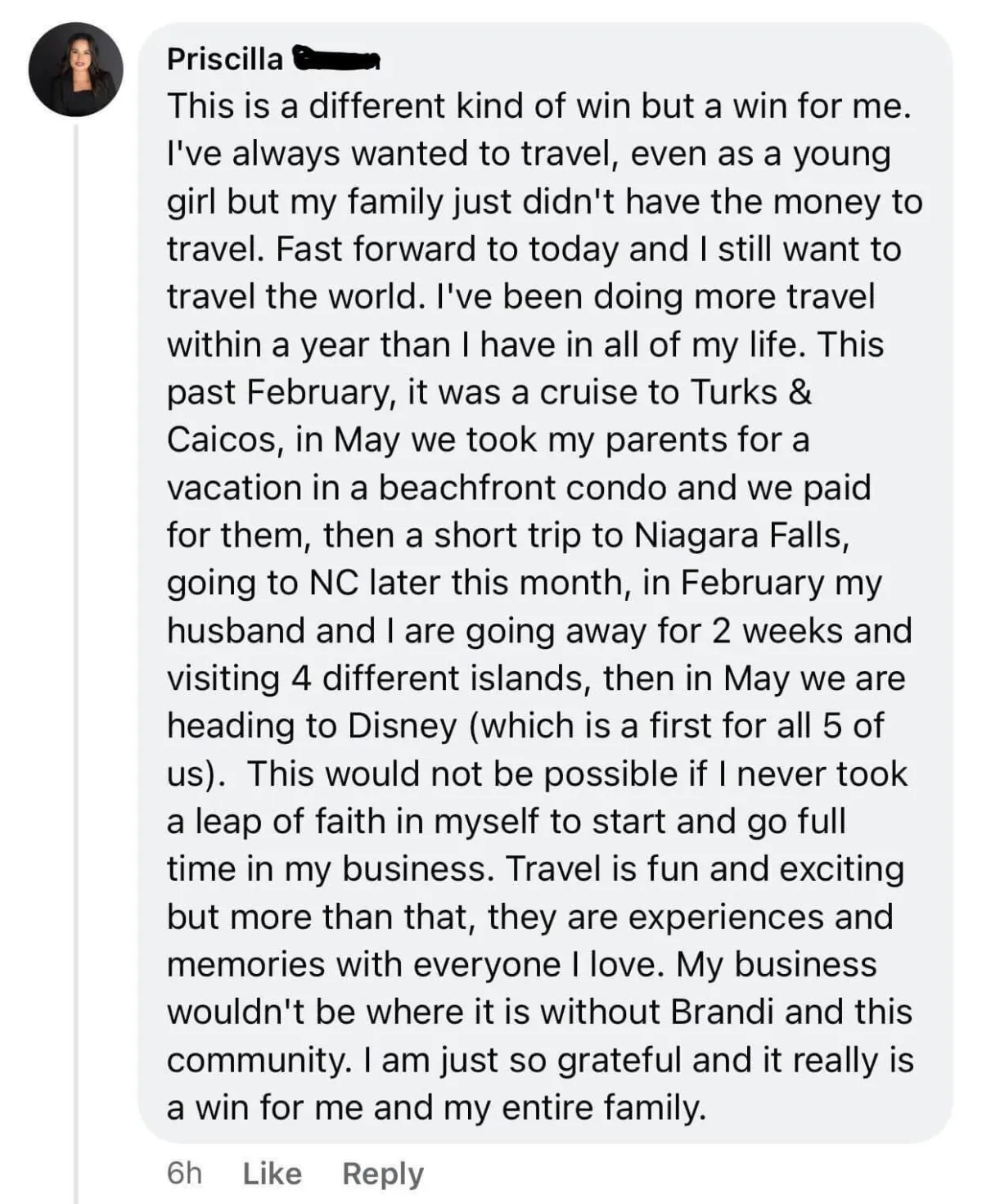

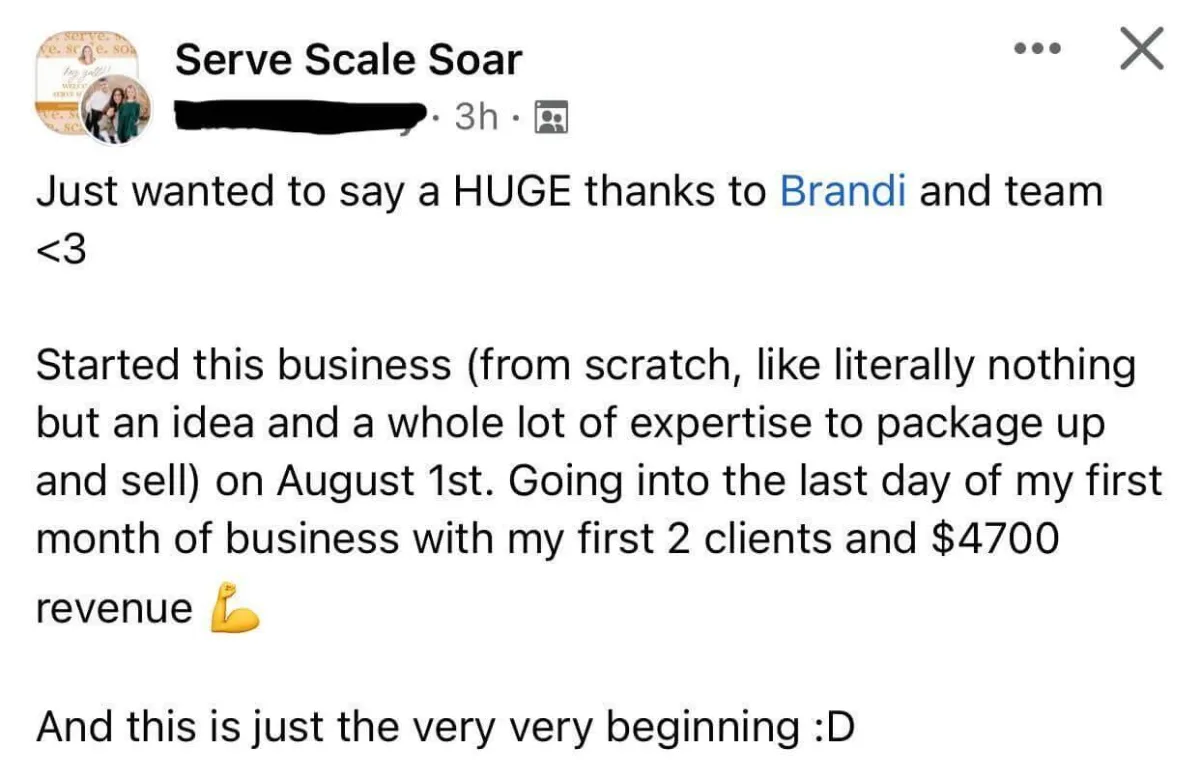

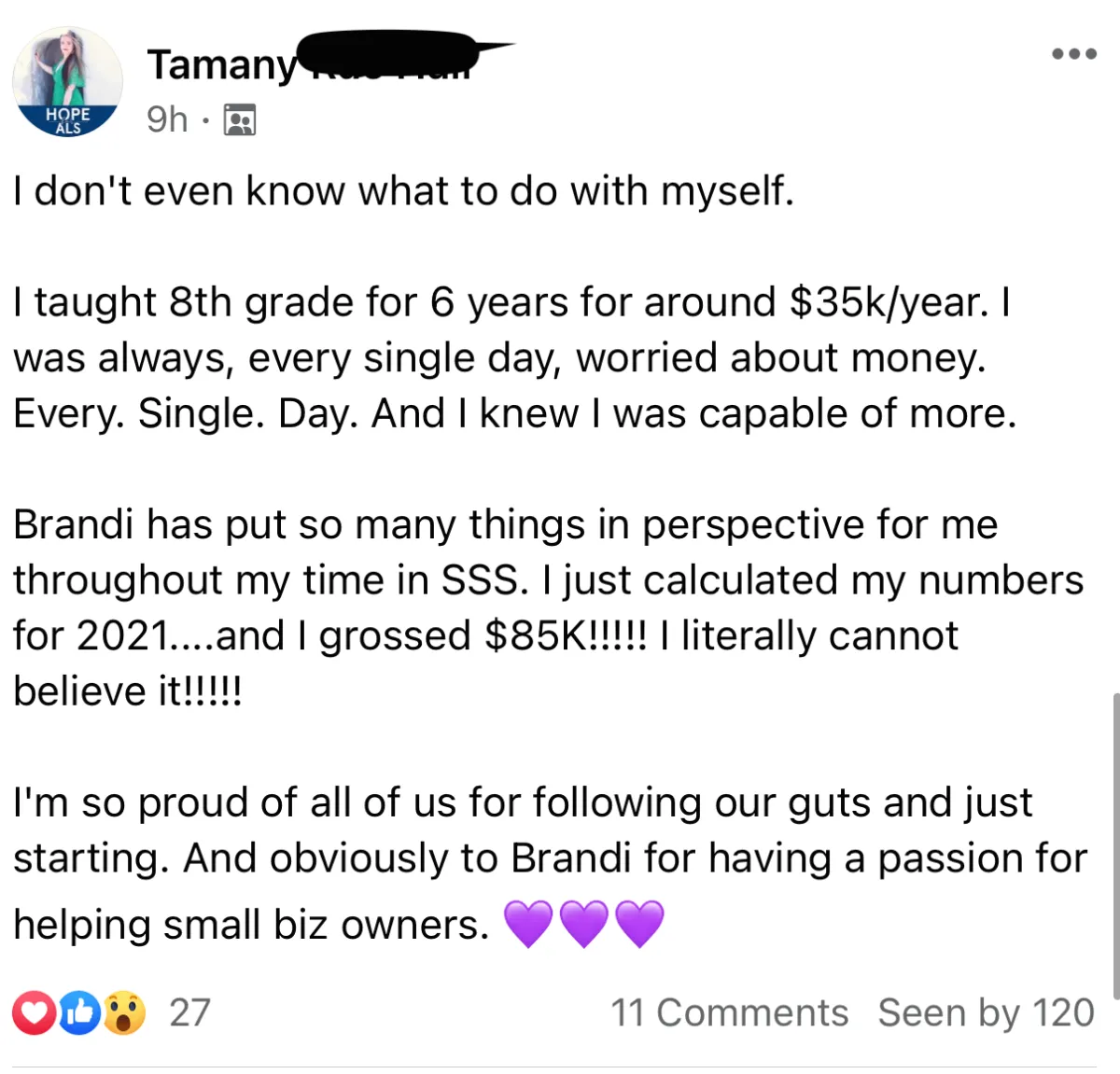

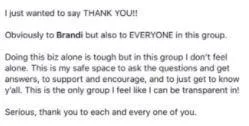

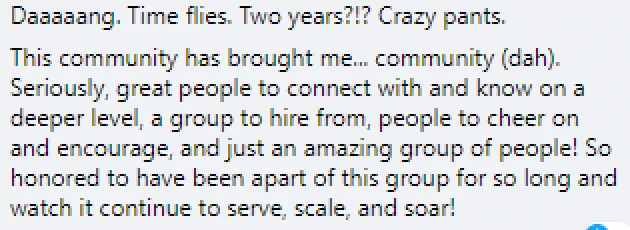

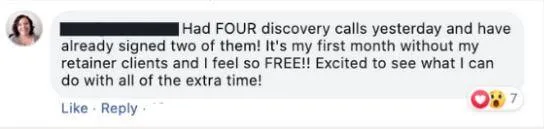

Here's What Current Members Have

To Say About Serve Scale Soar®

ANDREA - SEO SPECIALIST

“…I hit my biggest month and I brought in $12,000 and I started with making nothing. It is the best decision I ever made.”

As A Member Of Serve Scale Soar®

Here's What You'll Get Every Single Month

MONTHLY DELIVERABLE #1

ACTION PLAN + DEEP DIVE TRAINING

A hyper-focused action-oriented step-by-step plan for the month and a deep dive training into a specific topic with me (and sometimes a guest) so you know exactly how to execute the Action Plan. These strategies will help you take strategic action in your business that month without wondering what the heck you should be focusing on and cut the overwhelm of doing #allthethings.

Check Out Some Topics We've Covered & Upcoming Topics..

How To Find Clients On LinkedIn: Your Guide To Connections + Content.

Know Your Numbers: Ready To Grow In 2023. Track these numbers and watch your business Soar.

Spring Clean Your Business: Turn your hotmess express into a well oiled machine.

Pitch It Perfect: Get Featured On Your Favorite Podcast & Find Your Next Client.

Check Out Some Templates Waiting For Your Inside When You Join.

Contract Template -- Drafted By A Licensed Attorney

Discovery Call Application Questions From 10 Different Service Provider Niches.

All the email templates you'll need to run your business with ease.

Proposal templates to help you stand out in a crowded inbox.

MONTHLY DELIVERABLE #2

TEMPLATE OF THE MONTH

These templates are the exact same templates I use in my business -- I'm all about making your business and life easier and keeping things simple. So that's why I decided to give you a template each month to help execute your Action Plans and tasks in your business FASTER without recreating the wheel. You'll get a new plug-in-play template every single month to master implementing everything you learn inside Serve Scale Soar®.

Walk Away With:

- Bullet point goes here. Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem

- Bullet point goes here. Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem

- Bullet point goes here. Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem

- Bullet point goes here. Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem

MONTHLY DELIVERABLE #3

LIVE Q&A WITH ME, YOUR HOST BRANDI

No matter if you're just getting started or a seasoned pro we always have questions about your business and how to move forward or get unstuck -- With Serve Scale Soar® you'll have a place to get all your questions answered in our Monthly Q&A session. This is your chance to gain clarity, cut the confusion, and take a leap forward.

PLUS CHECK THIS OUT...

Can't make it to the live. No worries submit your question before hand and still get your answers.

You'll have access to 4 years of Q&As and they are all key word searchable. So need your answer fast? Check out our searchable Q&A answer vault.

All recordings are available within 24 hours to rewatch, listen or download the transcript.

JUST WHEN YOU THOUGHT IT COULDN'T GET ANY BETTER...

IT'S TIME TO RELEASE THE BONUSES...

SYSTEMS SETUP WITH EASE

HONEYBOOK IN A HURRY +

DELIGHTED WITH DUBSADO

01

Want to know the secret to getting more time back in your business? SYSTEMS. And not the overcomplicated kind that require a ton of automated workflows and expensive software. But the kind that put you at ease and allow you to spend half the time in the backend of your business and more time doing the work you love doing. That's why we created these two bonuses. So no matter if you're using Honeybook or Dubsado you'll be able to get your CRM set up in a weekend without any tech nightmares.

find your ideal clients

CLIENT ATTRACTION DOUBLE TIME

02

I know the one thing we always want... more clients! I get it! You're racing towards your next goal and the best way to hit it is with more clients... and not just any client but our dream clients!

Well... look no further! This BONUS BUNDLE was created with YOU in mind! You'll get two client-attracting trainings that I just know you're gonna love!

You'll get your hands on my Facebook To Client Accelerator Program and my LinkedIn to Client Accelerator Program.

In these step-by-step mini courses I'll show you exactly how to use the power of LinkedIn and Facebook Groups to find your first or next 10 clients. And how to stand out in the crowd so your books are full of Discovery calls.

Let's add dates and get it done

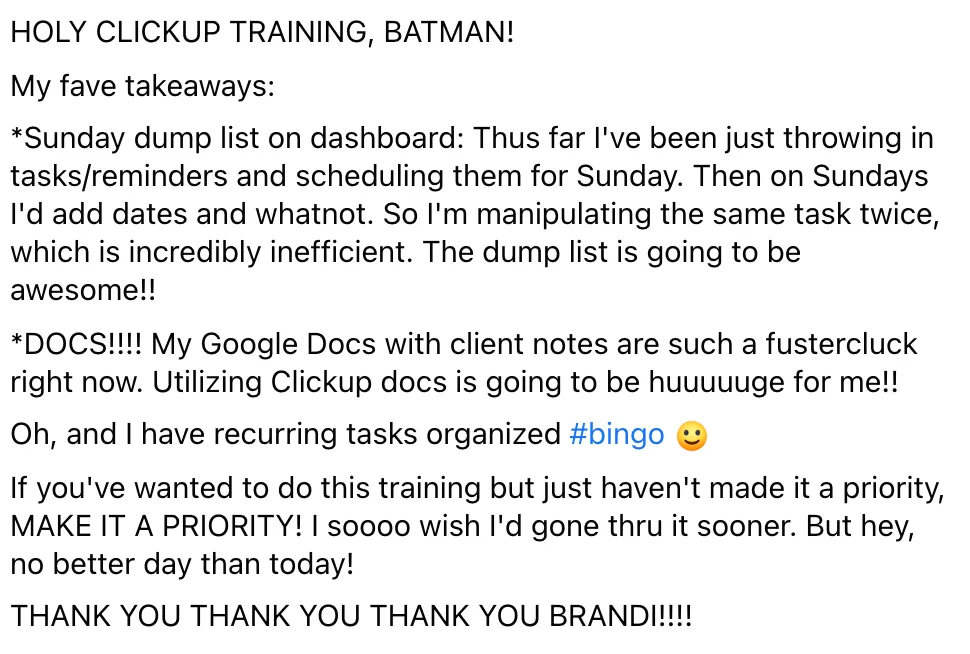

ClickUp For Client Management

03

Maybe you're brand new to using a Project Management tool or you're just not in love with the one you're currently using. Or worse, you have one but it's too dang confusing to set it up... then this BONUS was made for you!

I've included a full step-by-step course to help you get ClickUp set up and start conquering your to-do list, so you can get more time without dropping the ball or forgetting any tasks...

Yes! let's do the dang thing...

Join us Inside

Serve Scale Soar®

Choose Your Subscription Plan

PAY MONTHLY

$97/MONTH

This option is for service providers, who know success is a just around the corner (even if they are just getting started)...

And are excited to take advantage of a lower entry point and enroll in a community that will offer the support they need to start and grow their service-based business faster and put profit in their pocket so they can show up for themself and their family in a big freakin' way.

YOU'LL RECEIVE THESE EACH MONTH

Action Plan Of The Month

Deep Dive Training With Brandi

Template Of The Month

Live Q&A for the questions you need answered with Brandi

PLUS YOU'LL UNLOCK THESE BONUSES

Scale With Simplicity™ Course

All Previous Trainings and Templates

Keys To Our Bonus Vault -- Packed With Mini Courses To Help You Find Clients & Get Your Systems Set Up Fast!

no buyers remorse here! you can cancel your membership at any time even though you probably wont want to.

MOST POPULAR

$970/YEAR

This option is for someone who is serious about long-term growth in their business and loves to take advantage of a GREAT deal. By enrolling in an annual membership, you'll not only get the best price, but you'll also unlock these special perks.

YOU'LL RECEIVE THESE EACH MONTH

Action Plan Of The Month

Deep Dive Training With Brandi

Template Of The Month

Live Q&A for the questions you need answered with Brandi

PLUS YOU'LL UNLOCK THESE BONUSES

Scale With Simplicity™ Course

All Previous Trainings and Templates

Keys To Our Bonus Vault -- Packed With Mini Courses To Help You Find Clients & Get Your Systems Set Up Fast!

PLUS YOU'LL UNLOCK THESE ADDITIONAL BONUSES FOR

ANNUAL MEMBERS ONLY

Get TWO months free (save $194)

Get added to our Preferred Service Provider Directory

Access To My Private Scale With Simplicity™ Podcast

Access To Our Private Monthly Serve Scale Soar® Members Only Podcast

30 day money back guarantee.

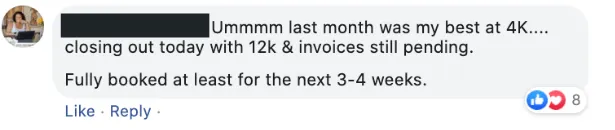

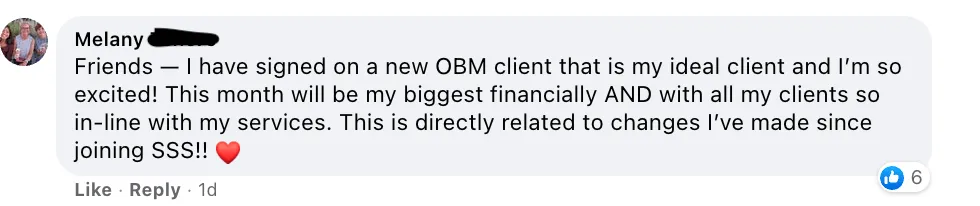

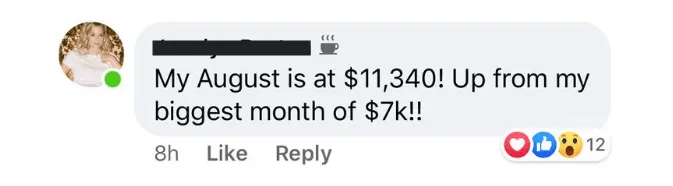

REAL PEOPLE + REAL RESULTS

A SMALL SAMPLE OF OUR

AMAZING MEMBER WINS

Caroline - Ad Manager

"I quit my job in May because of Brandi's coaching and training."

"I've been able to uplevel my business from basically freelance to a complete robust digital marketing company. And it wouldn't have been possible without Brandi's support and the support of her amazing community.

I had like three clients , and now I'm looking at like 12 clients. So without Serve Scale Soar I don't think that it would have been possible. It really gave me the confidence I needed..."

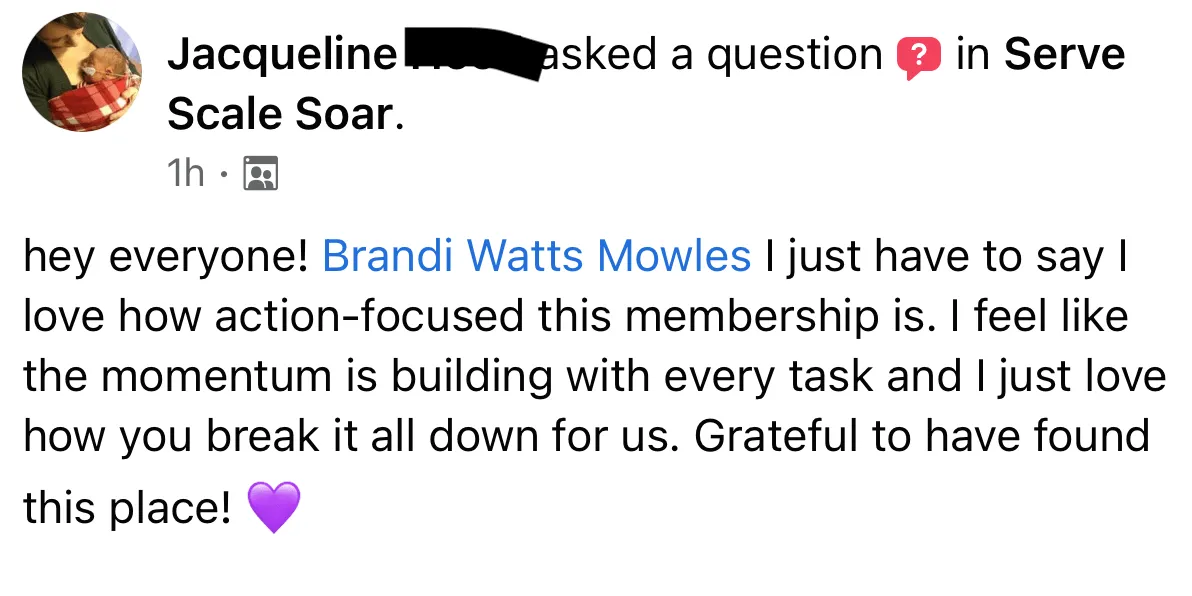

Jacqueline - Social Media Manager

"Can I just say how incredible this membership is!"

I onboarded two new clients this week and because I had everything set up in Dubsado - not only did it take me 5 minutes, but I totally wow'ed them with how professional and seamless everything looked!

My organizational brain is LOVING these systems and processes. Thank you Brandi Watts Mowles!!

Elise - Online Business Manager

"first 6-months, I’ve grossed more than I grossed all of last year"

In Serve Scale Soar I’ve learned how to be more confident with pricing myself for the value that I bring to a business. In the first 6-months, I’ve grossed more than I grossed all of last year. I have hit over $10k for the last two months, and am looking forward to next month’s income.

When You COMMIT TO SERVE SCALE SOAR®, YOU'RE SAYing YES TO DOING THINGS DIFFERENTLY

Imagine stepping into your definition of success...

You're providing top notch service to your dream clients, getting them results while growing your business and charging a premium price that finally allows you to hit your goals.

You're running your business with stress-free success and you know how to make decisions every step of the way that will contribute to your long term success. You're stepping into your role as a expert in your niche with confidence and clarity and feeling joy in your business and in what you do.

You're making consistent revenue and contributing to your family's income and finally getting to live your life full of choices. Whether that's going to Disney, traveling the world, sending your kids to private school, paying off debt, building or dream home or maybe just buying organic at the grocery store. And you're doing it without being tied to your laptop 24/7.

Burning Questions your fellow service providers asked before jumping in

Hey Brandi, can I expect to scale to $10K per month immediately… even if my business is new?

I don’t want to promise you can make $XYZ in a certain amount of time because it’s all relative based on how many actions you take and how you choose to run your business.

If you dive in fully, commit yourself to it, and have the right mindset, you could very realistically double your income within the first two to three months.

I will promise you that you’ll have the framework and community you need to scale FAST.

I worry that I won’t get results… how will this membership ensure I’m getting results?

If you’re feeling this way, you’re not alone.

This membership is ALL about getting you results.

So, not only do you get my direct help once a month with “office hours” Q&A calls…

...you also get to be part of the private Facebook group, get monthly Deep Dive Trainings and Templates and then you'll have a proven step-by-step Action Plan to follow each month.

You’ll be able to ask questions and get daily help, feedback, ideas, and network. And I am always popping into the group to answer questions too.

So, in addition to the step-by-step training, you also have tons of opportunities to get additional help to ENSURE you’re getting results.

If I am just getting started, and I don't have a business yet, is this still a good fit for me?

Serve Scale Soar® was created for those who want to provide 1:1 done-for-you services and work remotely. If that's you, then it will help you start your business and then scale it. The beautiful thing about this program is that it works for people brand new to offering services online and seasoned service providers, due to the nature of the 4 phases, which you’ll cycle through over and over again. So yes, if you’re just getting started, this is 100% for you.

Will this membership only work if I’m hustling like a lunatic 70+ hours/week?

Hah! Heck no.

I created Serve Scale Soar specifically to help online service-based entrepreneurs build a profitable business, while creating a life they love!

When you have access to the most efficient and effective client management process tools, templates, and marketing plans available to you…

You can stop doing #allthethings and only spend your time on the things that move the needle.

I repeat (...because it needs to be repeated):

You do not and should not surrender your life, relationships, and family to build your business.

I’ll show you how to scale without sacrifice or hiring a team.

Today is your chance to finally start, grow or scale

your business with simplicity and kick overwhelm to the curb.

If you're ready to start, grow, and scale your service-based business;

now is the time to get started

Since 2020 the world has changed and it's continuing to change even now in 2023. And one of the big changes being made is the amount of companies turning to remote workers, freelancers, and consultants as they lessen how many employees they have full time.

But not only that more and more companies are turning to online to run their companies, they are creating funnels, running digital ads, tapping into the power of podcast, and using online business managers. So businesses that may not have needed your services before are needing them now.

Inside Serve Scale Soar® over the last 3 years we have had members celebrating their BEST months even during a pandemic because now, more than ever, people need online help! It has seriously never been a better time to start, grow, and scale your online service-based business. So what are you waiting for?

Show off just how much easier, lighter, happier, better things will be when this solution is placed into their lives.

HERE'S A HUGE BENEFIT

Lorem ipsum dolor sit amet, consectetur elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae. Harum ducimus cupiditate similique quisquam et deserunt

HERE'S A HUGE BENEFIT

Lorem ipsum dolor sit amet, consectetur elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae. Harum ducimus cupiditate similique quisquam et deserunt

HERE'S A HUGE BENEFIT

Lorem ipsum dolor sit amet, consectetur elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae. Harum ducimus cupiditate similique quisquam et deserunt

Yes! let's do the dang thing...

Join us Inside

Serve Scale Soar®

Choose Your Subscription Plan

PAY MONTHLY

$97/MONTH

This option is for service providers, who know success is a just around the corner (even if they are just getting started)...

And are excited to take advantage of a lower entry point and enroll in a community that will offer the support they need to start and grow their service-based business faster and put profit in their pocket so they can show up for themself and their family in a big freakin' way.

YOU'LL RECEIVE THESE EACH MONTH

Action Plan Of The Month

Deep Dive Training With Brandi

Template Of The Month

Live Q&A for the questions you need answered with Brandi

PLUS YOU'LL UNLOCK THESE BONUSES

Scale With Simplicity™ Course

All Previous Trainings and Templates

Keys To Our Bonus Vault -- Packed With Mini Courses To Help You Find Clients & Get Your Systems Set Up Fast!

no buyers remorse here! you can cancel your membership at any time even though you probably wont want to.

MOST POPULAR

$970/YEAR

This option is for someone who is serious about long-term growth in their business and loves to take advantage of a GREAT deal. By enrolling in an annual membership, you'll not only get the best price, but you'll also unlock these special perks.

YOU'LL RECEIVE THESE EACH MONTH

Action Plan Of The Month

Deep Dive Training With Brandi

Template Of The Month

Live Q&A for the questions you need answered with Brandi

PLUS YOU'LL UNLOCK THESE BONUSES

Scale With Simplicity™ Course

All Previous Trainings and Templates

Keys To Our Bonus Vault -- Packed With Mini Courses To Help You Find Clients & Get Your Systems Set Up Fast!

PLUS YOU'LL UNLOCK THESE ADDITIONAL BONUSES FOR

ANNUAL MEMBERS ONLY

Get TWO months free (save $194)

Get added to our Preferred Service Provider Directory

Access To My Private Scale With Simplicity™ Podcast

Access To Our Private Monthly Serve Scale Soar® Members Only Podcast

30 day money back guarantee.

Branidmowles.com - All Rights Reserved - Terms & Conditions - privacy policy - earning disclaimer